Show Posts Show Posts

|

|

Pages: 1 [2] 3 4 ... 12

|

|

41

|

The Economy / Taxation / Tens Of Thousands Of Formerly Middle Class Americans Are Sleeping In Their Cars

|

on: July 13, 2011, 02:16:12 pm

|

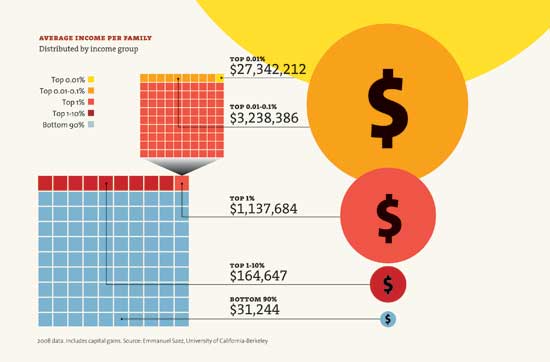

"Queen Elizabeth II, head of state of the United Kingdom and of 31 other states and territories, is the legal owner of about 6,600 million acres of land, one sixth of the earth’s non ocean surface. "She is the only person on earth who owns whole countries, and who owns countries that are not her own domestic territory. This land ownership is separate from her role as head of state and is different from other monarchies where no such claim is made – Norway, Belgium, Denmark etc. "The value of her land holding. £17,600,000,000,000 (approx)." “Given a stationary population and private ownership of all land, improvements in manufacturing methods do not, in the long-run, increase the earnings of labour and capital, but are absorbed by rent.” "I am using the word wages not in the sense of a quantity, but in the sense of proportion. When I say that wages fall as rent rises, I do not mean that the quantity of wealth obtained by laborers as wages is necessarily less, but that the proportion which it bears to the whole produce is necessarily less. The proportion may diminish while the quantity remains the same or even increases." "Place one hundred men on an island from which there is no escape, and whether you make one of these men the absolute owner of the other ninety-nine, or the absolute owner of the soil of the island, will make no difference either to him or to them. "In the one case, as the other, the one will be the absolute master of the ninety-nine--his power extending even to life and death, for simply to refuse them permission to live upon the island would be to force them into the sea. "Upon a larger scale, and through more complex relations, the same cause must operate in the same way and to the same end--the ultimate result, the enslavement of laborers, becoming apparent just as the pressure increases which compels them to live on and from land which is treated as the exclusive property of others. Take a country in which the soil is divided among a number of proprietors, instead of being in the hands of one, and in which, as in modern production, the capitalist has been specialized from the laborer, and manufacturers and exchange, in all their many branches, have been separated from agriculture. Though less direct and obvious, the relations between the owners of the soil and the laborers will, with the increase of population and the improvement of the arts, tend to the same absolute master on the one hand and the same abject helplessness on the other, as in the case of the island we have supposed. Rent will advance, while wages will fall." "A family in the United States needs to earn $18.44 an hour, or nearly $38,360 a year, in order to afford a modest rental home, according to a report released April 21 by the National Low Income Housing Coalition. Despite the recession, the report finds that rents continue to rise, while wages continue to fall across the country." Keep the above in mind as you read the following: --------------------------------- http://www.prisonplanet.com/outcasts-tonight-tens-of-thousands-of-formerly-middle-class-americans-will-be-sleeping-in-their-cars-in-tent-cities-or-on-the-streets.htmlTonight Tens Of Thousands Of Formerly Middle Class Americans Will Be Sleeping In Their Cars The Economic CollapseJuly 13, 2011  Economic despair is beginning to spread rapidly in America. As you read this, there are millions of American families that are just barely hanging on by their fingernails. For a growing number of Americans, it has become an all-out battle just to be able to afford to sleep under a roof and put a little bit of food on the table. Sadly, there are more people than ever that are losing that battle. Tonight, tens of thousands of formerly middle class Americans will be sleeping in their cars, even though that is illegal in many U.S. cities. Tens of thousands of others will be sleeping in tent cities or on the streets. Meanwhile, communities all over America are passing measures that are meant to push tent cities and homeless people out of their areas. It turns out that once you lose your job and your home in this country you become something of an outcast. Sadly, the number of “outcasts” is going to continue to grow as the U.S. economy continues to collapse. Most Americans that end up living in their cars on in tent cities never thought that it would happen to them. An article in Der Spiegel profiled one American couple that is absolutely shocked at what has happened to them…. Chanelle Sabedra is already on that road. She and her husband have been sleeping in their car for almost three weeks now. “We never saw this coming, never ever,” says Sabedra. She starts to cry. “I’m an adult, I can take care of myself one way or another, and same with my husband, but (my kids are) too little to go through these things.” She has three children; they are nine, five and three years old.

“We had a house further south, in San Bernardino,” says Sabedra. Her husband lost his job building prefab houses in July 2009. The utility company turned off the gas. “We were boiling water on the barbeque to bathe our kids,” she says. No longer able to pay the rent, the Sabedras were evicted from their house in August. How would you feel if you had a 3 year old kid and a 5 year old kid and you were sleeping in a car? Sadly, if child protective services finds out about that family those kids will probably be stolen away and never returned. America is becoming a very cruel place. Unfortunately, what has happened to that family is not an isolated incident. [ Continued...] --------------------------------- If anyone thinks this trend of people being rack-rented out of their homes started only a few years ago, think again: --------------------------------- High California rents push working poor to cheap motelsCNN.com October 30, 2000 ANAHEIM, California (CNN) -- Home for Yolanda Miramontes and her five children is a cheap motel room in Anaheim, California, a thriving city where the average apartment rents for $1,200 a month. Southern California's booming economy has pushed rents so high that most apartments are far out of reach for low-income families. And that's contributing to a growing trend: entire families living -- permanently or semi-permanently -- in motels. In Anaheim, population 310,000, as many as 2,000 people are full-time motel residents. "It's hard on the kids," Miramontes told CNN. "Although they call this home, I still can't accept it." With few low-income housing projects underway, the working poor have been squeezed out of the housing market and into small motel rooms renting for $600 a month -- roughly $20 a day. "I think this is the best place for us to be right now while we are looking for somewhere else," said Ebony Green, another motel dweller in Anaheim. Renters 'are no longer the unemployed'The Covered Wagon, a 70-unit motel in Anaheim, gets most of its business from locals. "What's different is that the people who are staying here are no longer the unemployed," said owner Jim Parkin. His renters include parents who work at restaurants, amusement parks, gas stations and other service establishments in Orange County, home to such tourist magnets as Disneyland and Knotts Berry Farm. "There's no one here collecting cans," Parkin told the Los Angeles Times. While there are no precise statistics on motel dwellers, motel owners in Anaheim, Long Beach and Van Nuys told the newspaper they've seen dramatic increases in the number of long-term motel residents. "We are reaching an unparalleled crisis in our housing," said Gary Squier, a consultant and former head of the Los Angeles Housing Department. [ Continued...] --------------------------------- Yet what do privilege-worshipping right-wingers propose as a solution? Make socially-created land rent even more privatized than it already is, even though this will not only make the rent-wage gap even wider than it already is, but will ensure that governments continue to impose job-destroying taxes on the privately created values of labor and capital!  |

|

|

|

|

42

|

The Economy / Taxation / Re: Is the Real Estate Market Voluntary?

|

on: July 12, 2011, 02:48:55 pm

|

Perhaps the most important conclusion to be drawn from the above article is that, contrary to what right-wing critics of Henry George’s Single Tax would have everyone blindly believe, the payment of land rent is “compulsory” regardless of whether or not it’s diverted into the public treasury. Why? Two reasons. First, because land itself is fixed in both supply and location. If you go to a furniture store and buy, let’s say, 20 square feet of carpeting, is there automatically that much less carpeting to go around for everyone else? Of course not. Why? Because new carpeting is being produced all the time. The same principle applies to all other products of human labor. But with land it’s the very opposite: since land is fixed in both supply and location, if I appropriate so many acres or square miles of it, then there is that much less for everyone else. Hence Adam Smith’s conclusion that: "The rent of the land, therefore, considered as the price paid for the use of the land, is naturally a monopoly price." -- The Wealth of Nations, Book 1, Chapter 11 Thus, if the Queen of England gets to assert exclusive, unconditional “ownership” of the billions of acres of land to which she holds title, then every other overprivileged aristocrat and absentee landlord gets to do likewise. The end result? An artificial scarcity of available land. And it is this artificial scarcity that allows landlords and slumlords to continually rent gouge landless wage-earners to such an extent that the latter rarely have more disposable income than is needed just to survive (many times not even that much -- hence the growing trend of college graduates having to move back in with their parents). Secondly, because access to land is a universal precondition to life itself. Thus, in a world in which all land has been appropriated by a mere subset of the population, and in which billions of people are continually driven by the threat of either starvation or harsh weather into competing for access to it, land rent gets paid either way -- and is paid under penalty of "force" either way (as any sheriff who’s had to evict unemployed tenants at gunpoint will readily attest). Reactionary defenders of privilege often object to this by asserting that, since wage-earners get to choose "who" they pay land rent to, it’s a “voluntary” payment. But as Dr. Fred Foldvary explains in the above article, this is misleading at best, because it conveniently ignores the fact that -- due to the two reasons just mentioned -- they have no real “choice” as to whether they pay, since the only “alternative” to paying is to either beg and grovel for charity or (if no charity is granted) simply starve.  This may be easier for some to understand if we consider the issue of chattel slavery. Would a chattel slave in the 19th century have been any less of a slave if he got to “choose” who his slavemaster was? Of course not. Why? Because he still wouldn’t have been free to choose whether he had a slavemaster to begin with. "Would the essence of slavery change if the rules at a slave auction permitted a slave to choose between the two highest bidders for himself? Could the fact that he made such a choice be interpreted as his sanction for his chains? How can it be argued that the citizen is free in a democracy when he has the choice of two candidates if neither candidate is willing to recognize his right to freedom?" Same principle here. A person isn’t truly free unless he has not only the choice of who gets to exact tribute from him in exchange for a mere place to stand without being threatened or shot at, but the choice of whether he has to pay such tribute to anyone in the first place. And the bottom line is: in an Austrian School economy, millions if not billions of people would have only the former choice, not the latter -- that is to say, they’d have only the choice of to whom they pay feudal tribute, not whether they pay. Thus, since the payment of land rent is compulsory regardless of whether it’s collected publicly or privately, the only question is, Does such payment constitute “feudal tribute” regardless of who the recipient is? The short answer is “no.” To understand why, consider the following analogy. Let’s say I invent a one-of-a-kind machine that generates unlimited electricity, and that I will it equally to my five sons. Once I pass away, the question immediately arises as to how to adjudicate disputes over who gets access to it, and on what terms. If the eldest son insists on enjoying exclusive possession of my machine, then the government-enforced payment of rent to the other four is, in that context, not a tribute for using that machine, but a fee for the state-sanctioned privilege of denying use of it to those who have an equal right to it. But what if we’re in an Austrian School economy, and what if, realizing this, the eldest son “mixes his labor” with the machine by cleaning it and painting it a different color? Then the court system will likely rule that any and all rental value that is generated by the ongoing competition for exclusive access to the machine is the “private property” of the eldest son. In that context, the payment of rent to the eldest son is not a fee for the privilege of denying use of the machine to those who are thereby dispossessed of their birthright, but a tribute paid by one of the dispossessed for mere access to that which, in reality, he has as much a “right” to as the one receiving tribute. In the former context there is justice, because all five sons are treated as moral equals. In the latter context there is injustice, because they’re not treated as moral equals. Thus, whether the payment of land rent (returning now to the issue at hand) constitutes feudal tribute or not depends on to whom it’s paid. If it’s paid to titleholders, then it’s feudal tribute, because it’s based on the aristocratic notion of the earth being that to which titleholders have an exclusive right of access. If it’s paid instead (whether directly as a citizen’s dividend or indirectly through the rent-financed provision of public goods and services) to those who’ve been dispossessed of their natural birthright, then it’s mere compensation, because it’s based on the recognition that the earth is that to which all humans (not just titleholders) have an equal right of access. To understand just how absurdly immoral and anti-“liberty” the Austrian School alternative is, imagine if someone proposed allowing wealthy rent-seekers to buy up all the air “with their hard-earned money” and begin charging everyone else rent for breathing “their” property. Most people, of course, would instinctively object to such a ridiculous proposal. But why they would object? Because they’d realize that the air we breathe is not provided or “allocated” to us by any person or group of persons presuming to “own” it all, but is made available to us by nature -- or by God, if you're religious -- and that to be denied access to it for failing to pay feudal tribute to an airlord is to have the property you have in yourself violated. Georgists simply apply the same principle to land, because, just as air itself is a free gift of nature, so too is land; and just as access to air is a universal precondition to life itself, so too is access to land. (I realize land and air have different physical characteristics, but in the two key respects I just mentioned, they’re very much the same.) As for the privatize-everything Austrian School, the bottom line is: if speculators could hoard the air the way they hoard land, and thereby confer to themselves the power of exacting a monthly ransom fee from those needing access to it to live, then, as long as there was a “free market” in the sale and purchase of air titles, there’d be slogan-parroting Austrians all over the place proudly defending this extortion racket in the name of (you guessed it) “liberty” and “private property rights.” They’d be saying things like, “Airlords aren’t parasitizing people through a form of legalized extortion as certain freedom-hating, property-rights-hating socialists have claimed; they’re merely ‘allocating’ the air to the most productive breathers.”  As ridiculous as that sounds, the sad reality is that, as long as those spouting such aristocratic nonsense were wrapped in the American flag or the flag of “liberty,” millions of gullible people would actually fall for this and start blindly defending the very system that’s parasitizing them -- insisting all the while that only those who hate liberty and private property would so much as question the legitimacy of that system. It’s right out of a George Orwell novel. Unfortunately, these are the kinds of reactionaries who’ve territorialized the anti- NWO (i.e., anti-war/anti-police state/anti-eugenics/anti-global government) movement, which no doubt pleases the global elite, because that means the number of people who compose this movement will never reach critical mass (since most of the millions of non-reactionaries out there simply have better things to do with their time than listen to label-obsessed reactionaries call them freedom-hating “socialists” and “communists” all day long). I can only hope that threads such as this one help to reverse that trend. |

|

|

|

|

43

|

The Economy / Taxation / Is the Real Estate Market Voluntary?

|

on: July 12, 2011, 02:19:54 pm

|

http://www.progress.org/archive/fold239.htmIs the Real Estate Market Voluntary? by Fred E. Foldvary The Progress Report 2002 Some critics of the use of rent for public finance claim that real estate transactions are voluntary, so no damage is done when the land rent is kept by the owner instead of being shared by the community. So let's examine the question, is the rent paid voluntarily? Critics of community rent claim that the payment of rent by a tenant is a voluntary payment for the service of finding tenants and allocating the best use of land. There are two issues involved in the issue of whether this is truly voluntary. First, is it voluntary not just for the agents involved, but for all society? Second, is it in fact voluntary for the agents? Take the example of pollution. If Bob the buyer pays Peter the polluter for a product Peter makes, this is voluntary between Bob and Peter. But in making the product, Peter has polluted the neighborhood, something that is not voluntary for the residents. Economists call this a "negative externality" as a cost imposed on others, not compensated by the polluter. The basic question here is, who is the morally proper owner of the land rent? If we agree that human beings are morally equal as persons and have equal natural rights, then the proper owner of natural land rent is all humanity in equal shares. In that case, when the landowner keeps all the land rent, he is stealing property that belongs to others, even if it is done legally. It is involuntary even if the members of the community do not claim this as their legitimate property, just as if a thief steals my radio and I don't know it is missing, the theft is still involuntary to me, as I did not consent to this taking. The second moral question is whether a land transaction is voluntary even for the landlord and the buyer or renter. It is true that nobody is pointing a gun at them and ordering them to rent the land from the landlord. But suppose someone put you in prison and there were several empty cells you could be put into. The guard says, choose one of the cells. Is this choice voluntary? Relative to the cells, yes, you choose one. But the greater context of being in prison is involuntary, so the choice of cells is also involuntary. The higher-level coercions flows down to the lower-level choices. It is like asking you, if you are to be executed, whether you would prefer to be hanged, shot, gassed, or electrocuted. If your higher-level preference is to live rather than die, these choices are coerced, since you would rather not make such choices in the first place. All land is monopolized, since new land cannot be created or imported. The landlords give you choice: which plot of land do you wish to be located in? You the tenant have no choice as to having to live on some land. Your only choice is which monopolist will take the rent that naturally and properly belongs to you in the first place as a member of the community. It is similar to the choice of prison cells. It is only superficially and by appearance a free choice, but the higher-level context of landlordism, of the landlords keeping rentals that do not properly belong to them, is mandated by the legal system imposed by government. So long as you are subject to that regime, you the tenant or buyer of land have no choice in substance. The slave trade was also a voluntary transaction between a seller and buyer of slaves, but it was not voluntary to the slave, who morally was the proper owner of his own labor. It may not have been even voluntary to the buyer of slaves if everyone else in the neighborhood owns slaves and it is impossible to compete with them unless you too are a slave owner. So only the overthrow of landlordism, the land tenure system where the title holder keeps all the natural rent, will make real-estate transactions truly voluntary. When the natural rent, due to the natural resource value, is shared by the community, including by using it for public revenue, then when a landlord rents to a tenant, this is truly voluntary, because the landowner is not taking what belongs to others. Then when a buyer purchases land, the purchase price is voluntary and also lower, because the rents belonging to others are not capitalized in the purchase price. Don't blame all the landlords. Most are locked into the prison system just as much as the tenants. Blame the system. Blame the ignorance of the public, the greed of politicians and the landed interests who actively prevent rent sharing, and the apathy of voters who don't want to be bothered to improve their knowledge of ethics, economics, and government.

|

|

|

|

|

44

|

The Economy / SOLUTIONS! / The Federal Reserve Cartel: Freemasons and The House of Rothschild

|

on: July 06, 2011, 01:54:32 pm

|

http://globalresearch.ca/index.php?context=va&aid=25179The Federal Reserve Cartel: Freemasons and The House of Rothschildby Dean Henderson  Global Research June 8, 2011 (Part two of a four-part series)In 1789 Alexander Hamilton became the first Treasury Secretary of the United States. Hamilton was one of many Founding Fathers who were Freemasons. He had close relations with the Rothschild family which owns the Bank of England and leads the European Freemason movement. George Washington, Benjamin Franklin, John Jay, Ethan Allen, Samuel Adams, Patrick Henry, John Brown and Roger Sherman were all Masons.  Andrew Hamilton Andrew HamiltonRoger Livingston helped Sherman and Franklin write the Declaration of Independence. He gave George Washington his oaths of office while he was Grand Master of the New York Grand Lodge of Freemasons. Washington himself was Grand Master of the Virginia Lodge. Of the General Officers in the Revolutionary Army, thirty-three were Masons. This was highly symbolic since 33rd Degree Masons become Illuminated. [1] Populist founding fathers led by John Adams, Thomas Jefferson, James Madison and Thomas Paine- none of whom were Masons- wanted to completely severe ties with the British Crown, but were overruled by the Masonic faction led by Washington, Hamilton and Grand Master of the St. Andrews Lodge in Boston General Joseph Warren, who wanted to “defy Parliament but remain loyal to the Crown”. St. Andrews Lodge was the hub of New World Masonry and began issuing Knights Templar Degrees in 1769. [2]  General Joseph Warren General Joseph WarrenAll US Masonic lodges are to this day warranted by the British Crown, whom they serve as a global intelligence and counterrevolutionary subversion network. Their most recent initiative is the Masonic Child Identification Program (CHIP). According to Wikipedia, the CHIP programs allow parents the opportunity to create a kit of identifying materials for their child, free of charge. The kit contains a fingerprint card, a physical description, a video, computer disk, or DVD of the child, a dental imprint, and a DNA sample. The First Continental Congress convened in Philadelphia in 1774 under the Presidency of Peyton Randolph, who succeeded Washington as Grand Master of the Virginia Lodge. The Second Continental Congress convened in 1775 under the Presidency of Freemason John Hancock. Peyton’s brother William succeeded him as Virginia Lodge Grand Master and became the leading proponent of centralization and federalism at the First Constitutional Convention in 1787. The federalism at the heart of the US Constitution is identical to the federalism laid out in the Freemason’s Anderson’s Constitutions of 1723. William Randolph became the nation’s first Attorney General and Secretary of State under George Washington. His family returned to England loyal to the Crown. John Marshall, the nation’s first Supreme Court Justice, was also a Mason. [3] When Benjamin Franklin journeyed to France to seek financial help for American revolutionaries, his meetings took place at Rothschild banks. He brokered arms sales via German Mason Baron von Steuben. His Committees of Correspondence operated through Freemason channels and paralleled a British spy network. In 1776 Franklin became de facto Ambassador to France. In 1779 he became Grand Master of the French Neuf Soeurs (Nine Sisters) Lodge, to which John Paul Jones and Voltaire belonged. Franklin was also a member of the more secretive Royal Lodge of Commanders of the Temple West of Carcasonne, whose members included Frederick Prince of Whales. While Franklin preached temperance in the US, he cavorted wildly with his Lodge brothers in Europe. Franklin served as Postmaster General from the 1750’s to 1775 - a role traditionally relegated to British spies. [4] With Rothschild financing Alexander Hamilton founded two New York banks, including Bank of New York. [5] He died in a gun battle with Aaron Burr, who founded Bank of Manhattan with Kuhn Loeb financing. Hamilton exemplified the contempt which the Eight Families hold towards common people, once stating, “All communities divide themselves into the few and the many. The first are the rich and the well born, the others the mass of the people...The people are turbulent and changing; they seldom judge and determine right. Give therefore to the first class a distinct, permanent share of government. They will check the unsteadiness of the second.”[6] Hamilton was only the first in a series of Eight Families cronies to hold the key position of Treasury Secretary. In recent times Kennedy Treasury Secretary Douglas Dillon came from Dillon Read (now part of UBS Warburg). Nixon Treasury Secretaries David Kennedy and William Simon came from Continental Illinois Bank (now part of Bank of America) and Salomon Brothers (now part of Citigroup), respectively. Carter Treasury Secretary Michael Blumenthal came from Goldman Sachs, Reagan Treasury Secretary Donald Regan came from Merrill Lynch (now part of Bank of America), Bush Sr. Treasury Secretary Nicholas Brady came from Dillon Read (UBS Warburg) and both Clinton Treasury Secretary Robert Rubin and Bush Jr. Treasury Secretary Henry Paulson came from Goldman Sachs. Obama Treasury Secretary Tim Geithner worked at Kissinger Associates and the New York Fed. Thomas Jefferson argued that the United States needed a publicly-owned central bank so that European monarchs and aristocrats could not use the printing of money to control the affairs of the new nation. Jefferson extolled, “A country which expects to remain ignorant and free...expects that which has never been and that which will never be. There is scarcely a King in a hundred who would not, if he could, follow the example of Pharaoh – get first all the people’s money, then all their lands and then make them and their children servants forever...banking establishments are more dangerous than standing armies. Already they have raised up a money aristocracy.” Jefferson watched as the Euro-banking conspiracy to control the United States unfolded, weighing in, “Single acts of tyranny may be ascribed to the accidental opinion of the day, but a series of oppressions begun at a distinguished period, unalterable through every change of ministers, too plainly prove a deliberate, systematic plan of reducing us to slavery”. [7] But the Rothschild-sponsored Hamilton’s arguments for a private US central bank carried the day. In 1791 the Bank of the United States (BUS) was founded, with the Rothschilds as main owners. The bank’s charter was to run out in 1811. Public opinion ran in favor of revoking the charter and replacing it with a Jeffersonian public central bank. The debate was postponed as the nation was plunged by the Euro-bankers into the War of 1812. Amidst a climate of fear and economic hardship, Hamilton’s bank got its charter renewed in 1816. Old Hickory, Honest Abe & CamelotIn 1828 Andrew Jackson took a run at the US Presidency. Throughout his campaign he railed against the international bankers who controlled the BUS. Jackson ranted, “You are a den of vipers. I intend to expose you and by Eternal God I will rout you out. If the people understood the rank injustices of our money and banking system there would be a revolution before morning.” Jackson won the election and revoked the bank’s charter stating, “The Act seems to be predicated on an erroneous idea that the present shareholders have a prescriptive right to not only the favor, but the bounty of the government...for their benefit does this Act exclude the whole American people from competition in the purchase of this monopoly. Present stockholders and those inheriting their rights as successors be established a privileged order, clothed both with great political power and enjoying immense pecuniary advantages from their connection with government. Should its influence be concentrated under the operation of such an Act as this, in the hands of a self-elected directory whose interests are identified with those of the foreign stockholders, will there not be cause to tremble for the independence of our country in war...controlling our currency, receiving our public monies and holding thousands of our citizens independence, it would be more formidable and dangerous than the naval and military power of the enemy. It is to be regretted that the rich and powerful too often bend the acts of government for selfish purposes...to make the rich richer and more powerful. Many of our rich men have not been content with equal protection and equal benefits, but have besought us to make them richer by acts of Congress. I have done my duty to this country.”[8] Populism prevailed and Jackson was re-elected. In 1835 he was the target of an assassination attempt. The gunman was Richard Lawrence, who confessed that he was, “in touch with the powers in Europe”. [9] Still, in 1836 Jackson refused to renew the BUS charter. Under his watch the US national debt went to zero for the first and last time in our nation’s history. This angered the international bankers, whose primary income is derived from interest payments on debt. BUS President Nicholas Biddle cut off funding to the US government in 1842, plunging the US into a depression. Biddle was an agent for the Paris-based Jacob Rothschild. [10] The Mexican War was simultaneously sprung on Jackson. A few years later the Civil War was unleashed, with London bankers backing the Union and French bankers backing the South. The Lehman family made a fortune smuggling arms to the south and cotton to the north. By 1861 the US was $100 million in debt. New President Abraham Lincoln snubbed the Euro-bankers again, issuing Lincoln Greenbacks to pay Union Army bills. The Rothschild-controlled Times of London wrote, “If that mischievous policy, which had its origins in the North American Republic, should become indurated down to a fixture, then that Government will furnish its own money without cost. It will pay off its debts and be without debt. It will have all the money necessary to carry on its commerce. It will become prosperous beyond precedent in the history of the civilized governments of the world. The brains and the wealth of all countries will go to North America. That government must be destroyed, or it will destroy every monarchy on the globe.” [11] The Euro-banker-written Hazard Circular was exposed and circulated throughout the country by angry populists. It stated, “The great debt that capitalists will see is made out of the war and must be used to control the valve of money. To accomplish this government bonds must be used as a banking basis. We are now awaiting Secretary of Treasury Salmon Chase to make that recommendation. It will not allow Greenbacks to circulate as money as we cannot control that. We control bonds and through them banking issues”. The 1863 National Banking Act reinstated a private US central bank and Chase’s war bonds were issued. Lincoln was re-elected the next year, vowing to repeal the act after he took his January 1865 oaths of office. Before he could act, he was assassinated at the Ford Theatre by John Wilkes Booth. Booth had major connections to the international bankers. His granddaughter wrote This One Mad Act, which details Booth’s contact with “mysterious Europeans” just before the Lincoln assassination. Following the Lincoln hit, Booth was whisked away by members of a secret society known as Knights of the Golden Circle (KGC). KGC had close ties to the French Society of Seasons, which produced Karl Marx. KGC had fomented much of the tension that caused the Civil War and President Lincoln had specifically targeted the group. Booth was a KGC member and was connected through Confederate Secretary of State Judah Benjamin to the House of Rothschild. Benjamin fled to England after the Civil War. [12] Nearly a century after Lincoln was assassinated for issuing Greenbacks, President John F. Kennedy found himself in the Eight Families’ crosshairs. Kennedy had announced a crackdown on off-shore tax havens and proposed increases in tax rates on large oil and mining companies. He supported eliminating tax loopholes which benefit the super-rich. His economic policies were publicly attacked by Fortune magazine, the Wall Street Journal and both David and Nelson Rockefeller. Even Kennedy’s own Treasury Secretary Douglas Dillon, who came from the UBS Warburg-controlled Dillon Read investment bank, voiced opposition to the JFK proposals. [13] Kennedy’s fate was sealed in June 1963 when he authorized the issuance of more than $4 billion in United States Notes by his Treasury Department in an attempt to circumvent the high interest rate usury of the private Federal Reserve international banker crowd. The wife of Lee Harvey Oswald, who was conveniently gunned down by Jack Ruby before Ruby himself was shot, told author A. J. Weberman in 1994, “The answer to the Kennedy assassination is with the Federal Reserve Bank. Don’t underestimate that. It’s wrong to blame it on Angleton and the CIA per se only. This is only one finger on the same hand. The people who supply the money are above the CIA”. [14] Fueled by incoming President Lyndon Johnson’s immediate escalation of the Vietnam War, the US sank further into debt. Its citizens were terrorized into silence. If they could kill the President they could kill anyone. The House of RothschildThe Dutch House of Orange founded the Bank of Amsterdam in 1609 as the world’s first central bank. Prince William of Orange married into the English House of Windsor, taking King James II’s daughter Mary as his bride. The Orange Order Brotherhood, which recently fomented Northern Ireland Protestant violence, put William III on the English throne where he ruled both Holland and Britain. In 1694 William III teamed up with the UK aristocracy to launch the private Bank of England. The Old Lady of Threadneedle Street- as the Bank of England is known- is surrounded by thirty foot walls. Three floors beneath it the third largest stock of gold bullion in the world is stored. [15] The Rothschilds and their inbred Eight Families partners gradually came to control the Bank of England. The daily London gold “fixing” occurred at the N. M. Rothschild Bank until 2004. As Bank of England Deputy Governor George Blunden put it, “Fear is what makes the bank’s powers so acceptable. The bank is able to exert its influence when people are dependent on us and fear losing their privileges or when they are frightened.”[16] Mayer Amschel Rothschild sold the British government German Hessian mercenaries to fight against American Revolutionaries, diverting the proceeds to his brother Nathan in London, where N.M. (Nathan and Mayer) Rothschild & Sons was established. Mayer was a serious student of Cabala and launched his fortune on money embezzled from William IX- royal administrator of the Hesse-Kassel region and a prominent Freemason. Rothschild-controlled Barings bankrolled the Chinese opium and African slave trades. It financed the Louisiana Purchase. When several states defaulted on its loans, Barings bribed Daniel Webster to make speeches stressing the virtues of loan repayment. The states held their ground, so the House of Rothschild cut off the money spigot in 1842, plunging the US into a deep depression. It was often said that the wealth of the Rothschilds depended on the bankruptcy of nations. Mayer Amschel Rothschild once said, “I care not who controls a nation’s political affairs, so long as I control her currency”. [ Continued...]

|

|

|

|

|

45

|

The Economy / SOLUTIONS! / The Federal Reserve Cartel: The Eight Families

|

on: July 06, 2011, 01:52:34 pm

|

http://globalresearch.ca/index.php?context=va&aid=25080The Federal Reserve Cartel: The Eight Familiesby Dean Henderson  Global Research June 1, 2011 (Part one of a four-part series)

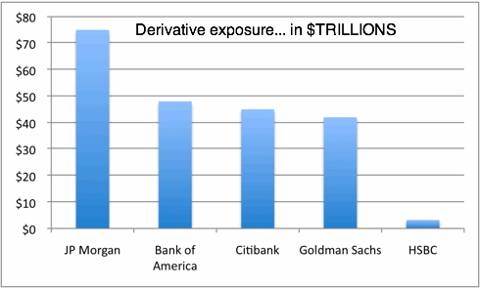

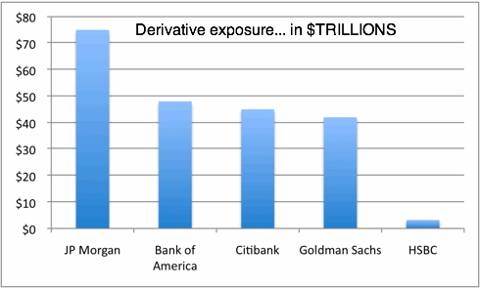

The Four Horsemen of Banking (Bank of America, JP Morgan Chase, Citigroup and Wells Fargo) own the Four Horsemen of Oil (Exxon Mobil, Royal Dutch/Shell, BP Amoco and Chevron Texaco); in tandem with Deutsche Bank, BNP, Barclays and other European old money behemoths. But their monopoly over the global economy does not end at the edge of the oil patch.According to company 10K filings to the SEC, the Four Horsemen of Banking are among the top ten stock holders of virtually every Fortune 500 corporation.[1] So who then are the stockholders in these money center banks? This information is guarded much more closely. My queries to bank regulatory agencies regarding stock ownership in the top 25 US bank holding companies were given Freedom of Information Act status, before being denied on “national security” grounds. This is rather ironic, since many of the bank’s stockholders reside in Europe. One important repository for the wealth of the global oligarchy that owns these bank holding companies is US Trust Corporation - founded in 1853 and now owned by Bank of America. A recent US Trust Corporate Director and Honorary Trustee was Walter Rothschild. Other directors included Daniel Davison of JP Morgan Chase, Richard Tucker of Exxon Mobil, Daniel Roberts of Citigroup and Marshall Schwartz of Morgan Stanley. [2] J. W. McCallister, an oil industry insider with House of Saud connections, wrote in The Grim Reaper that information he acquired from Saudi bankers cited 80% ownership of the New York Federal Reserve Bank- by far the most powerful Fed branch- by just eight families, four of which reside in the US. They are the Goldman Sachs, Rockefellers, Lehmans and Kuhn Loebs of New York; the Rothschilds of Paris and London; the Warburgs of Hamburg; the Lazards of Paris; and the Israel Moses Seifs of Rome. CPA Thomas D. Schauf corroborates McCallister’s claims, adding that ten banks control all twelve Federal Reserve Bank branches. He names N.M. Rothschild of London, Rothschild Bank of Berlin, Warburg Bank of Hamburg, Warburg Bank of Amsterdam, Lehman Brothers of New York, Lazard Brothers of Paris, Kuhn Loeb Bank of New York, Israel Moses Seif Bank of Italy, Goldman Sachs of New York and JP Morgan Chase Bank of New York. Schauf lists William Rockefeller, Paul Warburg, Jacob Schiff and James Stillman as individuals who own large shares of the Fed. [3] The Schiffs are insiders at Kuhn Loeb. The Stillmans are Citigroup insiders, who married into the Rockefeller clan at the turn of the century. Eustace Mullins came to the same conclusions in his book The Secrets of the Federal Reserve, in which he displays charts connecting the Fed and its member banks to the families of Rothschild, Warburg, Rockefeller and the others. [4] The control that these banking families exert over the global economy cannot be overstated and is quite intentionally shrouded in secrecy. Their corporate media arm is quick to discredit any information exposing this private central banking cartel as “ conspiracy theory”. Yet the facts remain. The House of Morgan The Federal Reserve Bank was born in 1913, the same year US banking scion J. Pierpont Morgan died and the Rockefeller Foundation was formed. The House of Morgan presided over American finance from the corner of Wall Street and Broad, acting as quasi-US central bank since 1838, when George Peabody founded it in London. Peabody was a business associate of the Rothschilds. In 1952 Fed researcher Eustace Mullins put forth the supposition that the Morgans were nothing more than Rothschild agents. Mullins wrote that the Rothschilds, “…preferred to operate anonymously in the US behind the facade of J.P. Morgan & Company”. [5] Author Gabriel Kolko stated, “Morgan’s activities in 1895-1896 in selling US gold bonds in Europe were based on an alliance with the House of Rothschild.” [6] The Morgan financial octopus wrapped its tentacles quickly around the globe. Morgan Grenfell operated in London. Morgan et Ce ruled Paris. The Rothschild's Lambert cousins set up Drexel & Company in Philadelphia. The House of Morgan catered to the Astors, DuPonts, Guggenheims, Vanderbilts and Rockefellers. It financed the launch of AT&T, General Motors, General Electric and DuPont. Like the London-based Rothschild and Barings banks, Morgan became part of the power structure in many countries. By 1890 the House of Morgan was lending to Egypt’s central bank, financing Russian railroads, floating Brazilian provincial government bonds and funding Argentine public works projects. A recession in 1893 enhanced Morgan’s power. That year Morgan saved the US government from a bank panic, forming a syndicate to prop up government reserves with a shipment of $62 million worth of Rothschild gold. [7] Morgan was the driving force behind Western expansion in the US, financing and controlling West-bound railroads through voting trusts. In 1879 Cornelius Vanderbilt’s Morgan-financed New York Central Railroad gave preferential shipping rates to John D. Rockefeller’s budding Standard Oil monopoly, cementing the Rockefeller/Morgan relationship. The House of Morgan now fell under Rothschild and Rockefeller family control. A New York Herald headline read, “Railroad Kings Form Gigantic Trust”. J. Pierpont Morgan, who once stated, “Competition is a sin”, now opined gleefully, “Think of it. All competing railroad traffic west of St. Louis placed in the control of about thirty men.”[8] Morgan and Edward Harriman’s banker Kuhn Loeb held a monopoly over the railroads, while banking dynasties Lehman, Goldman Sachs and Lazard joined the Rockefellers in controlling the US industrial base. [9] In 1903 Banker’s Trust was set up by the Eight Families. Benjamin Strong of Banker’s Trust was the first Governor of the New York Federal Reserve Bank. The 1913 creation of the Fed fused the power of the Eight Families to the military and diplomatic might of the US government. If their overseas loans went unpaid, the oligarchs could now deploy US Marines to collect the debts. Morgan, Chase and Citibank formed an international lending syndicate. [ Continued...]

|

|

|

|

|

47

|

The Economy / SOLUTIONS! / INFLATION FEARS: REAL OR HYSTERIA?

|

on: May 16, 2011, 11:29:06 am

|

Debate continues to rage between the inflationists who say the money supply is increasing, dangerously devaluing the currency, and the deflationists who say we need more money in the economy to stimulate productivity. The debate is not just an academic one, since the Fed’s monetary policy turns on it and so does Congressional budget policy. Inflation fears have been fueled ever since 2009, when the Fed began its policy of “quantitative easing” (effectively “money printing”). The inflationists point to commodity prices that have shot up. The deflationists, in turn, point to the housing market, which has collapsed and taken prices down with it. Prices of consumer products other than food and fuel are also down. Wages have remained stagnant, so higher food and gas prices mean people have less money to spend on consumer goods. The bubble in commodities, say the deflationists, has been triggered by the fear of inflation. Commodities are considered a safe haven, attracting a flood of “hot money” -- investment money racing from one hot investment to another. To resolve this debate, we need the actual money supply figures. Unfortunately, the Fed quit reporting M3, the largest measure of the money supply, in 2006. Fortunately, figures are still available for the individual components of M3. Here is a graph that is worth a thousand words. It comes from ShadowStats.com (Shadow Government Statistics or SGS) and is reconstructed from the available data on those components. The red line is the M3 money supply reported by the Fed until 2006. The blue line is M3 after 2006. The chart shows that the overall U.S. money supply is shrinking, despite the Fed’s determination to inflate it with quantitative easing. Like Japan, which has been doing quantitative easing (QE) for a decade, the U.S. is still fighting deflation. Here is another telling chart – the M1 Money Multiplier from the Federal Reserve Bank of St. Louis: Barry Ritholtz comments, “All that heavy breathing about the flood of liquidity that was going to pour into the system. Hyper-inflation! Except not so much, apparently.” He quotes David Rosenberg: “Fully 100% of both QEs by the Fed merely was new money printing that ended up sitting idly on commercial bank balance sheets. Money velocity and money multiplier are stagnant at best.” If QE1 and QE2 are sitting in bank reserve accounts, they’re not driving up the price of gold, silver, oil and food; and they’re not being multiplied into loans, which are still contracting. The part of M3 that collapsed in 2008 was the “shadow banking system,” including money market funds and repos. This is the non-bank system in which large institutional investors that have substantially more to deposit than $250,000 (the FDIC insurance limit) park their money overnight. Economist Gary Gorton explains [.pdf]: The financial crisis . . . was due to a banking panic in which institutional investors and firms refused to renew sale and repurchase agreements (repo) – short-term, collateralized, agreements that the Fed rightly used to count as money. Collateral for repo was, to a large extent, securitized bonds. Firms were forced to sell assets as a result of the banking panic, reducing bond prices and creating losses. There is nothing mysterious or irrational about the panic. There were genuine fears about the locations of subprime risk concentrations among counterparties. This banking system (the “shadow” or “parallel” banking system)-- repo based on securitization -- is a genuine banking system, as large as the traditional, regulated banking system. It is of critical importance to the economy because it is the funding basis for the traditional banking system. Without it, traditional banks will not lend, and credit, which is essential for job creation, will not be created. Before the banking crisis, the shadow banking system composed about half the money supply; and it still hasn’t been restored. Without the shadow banking system to fund bank loans, banks will not lend; and without credit, there is insufficient money to fund businesses, buy products, or pay salaries or taxes. Neither raising taxes nor slashing services will fix the problem. It needs to be addressed at its source, which means getting more credit (or debt) flowing in the local economy. When private debt falls off, public debt must increase to fill the void. Public debt is not the same as household debt, which debtors must pay off or face bankruptcy. The U.S. federal debt has not been paid off since 1835. Indeed, it has grown continuously since then, and the economy has grown and flourished along with it. As explained in an earlier article, the public debt is the people’s money. The government pays for goods and services by writing a check on the national bank account. Whether this payment is called a “bond” or a “dollar,” it is simply a debit against the credit of the nation. As Thomas Edison said in the 1920s: If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good, makes the bill good, also. The difference between the bond and the bill is the bond lets money brokers collect twice the amount of the bond and an additional 20%, whereas the currency pays nobody but those who contribute directly in some useful way. . . . It is absurd to say our country can issue $30 million in bonds and not $30 million in currency. Both are promises to pay, but one promise fattens the usurers and the other helps the people. That is true, but Congress no longer seems to have the option of issuing dollars, a privilege it has delegated to the Federal Reserve. Congress can, however, issue debt, which as Edison says amounts to the same thing. A bond can be cashed in quickly at face value. A bond is money, just as a dollar is. An accumulating public debt owed to the IMF or to foreign banks is to be avoided, but compounding interest charges can be eliminated by financing state and federal deficits through state- and federally-owned banks. Since the government would own the bank, the debt would effectively be interest-free. More important, it would be free of the demands of private creditors, including austerity measures and privatization of public assets. [ Continued...] |

|

|

|

|

48

|

The Economy / SOLUTIONS! / Twenty Frequently Asked Questions on The American Monetary Act (AMA)

|

on: May 16, 2011, 11:27:31 am

|

http://www.monetary.org/faq.htmlTwenty Frequently Asked Questions on The American Monetary Act (AMA) (August 8, 2009) For more background, see The Lost Science of Money (LSM) by Stephen Zarlenga, available at our website. 1) Won't the government creating new money for infrastructure and other expenses cause inflation?No. While this is an important concern, some of it is anti-governmental propaganda and it need not cause inflation, depending on where the new money goes, for example: When new money is used to create real wealth, such as goods and services and the $2.2 trillion worth of public infrastructure building and repair the engineers tell us is needed over the next 5 years, there need not be inflation because real things of real value are being created at the same time as the money, and the existence of those real values for living, keeps prices down. If it goes into warfare or bubbles (real estate/Wall Street/etc.) it would create inflationary bubbles with no real production of goods and services. That is the history of private control over money creation. It must end now. Government tends to direct resources more into areas of concern for the whole nation, such as infrastructure, health care, education, etc. The AMA Title 5 specifies infrastructure items including human infrastructure of health care and education to focus on. Also remember, the American Monetary Act eliminates ‘fractional reserve banking’ which has been one of the main causes of inflation. And remember new money must be introduced into circulation as the population and economy grow or is improved, or we’d have deflation. 2) How can we trust government with the power to create money? – Won’t they go wild (and again cause inflation)? Don’t you know that government can’t do anything right?Two Points: A. The U.S. Constitution binds government to represent the interests of the American people – “to promote the General Welfare” and empowers our Federal Government to create, issue and regulate our money (Article I, Section 8, Clause 5). We must hold our officeholders responsible to the laws. Do you want us to deny the Constitution? In favor of who? Enron? Bear Stearns? J.P. Morgan? Goldman Sachs? Lehman Brothers? Please get real! Our choice is to let those pirates continue to control our money system or to intelligently constitute the MONEY POWER within our government.Under the American Monetary Act, the Congress, the President and the Board of the Monetary Authority will all be responsible if any inflation or deflation takes place, and the people will know that they are responsible. They are specifically directed to avoid policies that are either inflationary or deflationary. Do you really trust the “ENRONS” to dominate our money? Look how they have abused that power! And Yes Damn it! Enron was on the Board of the Dallas Federal Reserve Bank!B. Finally and most importantly, an examination of history, despite the current prejudice and massive propaganda waged against government, shows that government control of money has a far superior historical record to private control over money systems. See the AMA brochure, and the LSM, Chapter 16. History shows that government has a far superior record in controlling the money system than private money creators have. And Yes, that includes the Continental Currency, The Greenbacks, and even the German hyperinflation; which by the way took place under a completely privatized German central bank! The German hyperinflation is really an example of a private money disaster. The Lost Science of Money book, chapter 12, uncovers the beginnings of the attack on government and found it started with Adam Smith himself in an attempt to block moves to take back the monetary power from the then private Bank of England, and put it back into government, which had done a good job in monarchical management of the money system, with only one exception under Henry VIII. 3) Why should we give the government even more power?Because our money system belongs to society as a whole. It is too important to trust to unrepresentative and unaccountable private hands, preoccupied with private gain, with little regard for the detrimental consequences of their actions on the country, and outside our system of checks and balances. Just look what they have done! 4) How can we prevent government from abusing its power once it can create money directly?The same way we prevent it from abusing any power, by upholding the rule of law and by participating in democratic political processes; and through reasonable structural limits. 5) Should we let private banks keep some part of the money creation privilege?Absolutely not! History shows that the private interests, if given any privileged power over money, eventually undermine the public interest, and take over the whole thing. We know this from historical case studies in at least 4 major historical situations – the U.S. “Greenbacks”, The nationalization of the Bank of England, and the Canadian and New Zealand monetary experience. Anyone who proposes allowing the banks to keep any part of the power to create money are either ignorant of monetary history or are shilling for the banks. Under the American Monetary Act we do have the best of both worlds. We keep the benefits of having the professionalism and expertise of a competitive banking system in the private sector, but we take away the dangers of having them dominate our monetary and public policies with their narrow short term profit focus, by removing their privilege to create money. Ultimately this is a question of morality. No such special privileges can be allowed to particular groups; especially the monetary privilege, which confers power and wealth on them at the expense of the rest of society. 6) Well then, should we nationalize all the banking business?What kind of “Kool Aid” are you drinking and who gave it to you? The banking business is obviously not a proper function of government; but providing, controlling and overseeing the monetary system is definitely a function of government. No private party can do that properly. Markets have utterly failed to do that. They have concentrated wealth, have harmed the average American and now broken down entirely, except for assistance from our government. Who would keep money in banks today, except for the FDIC guarantees? But banks should remain privately owned, because when reasonably structured, they perform very necessary functions, and can do it professionally and conveniently. Who within government would run the banking business? Bankers however, have nothing in their training, experience or their souls that qualifies them as masters of the universe – to control our society as the money power confers upon them. Banks should act as intermediaries for their clients who want to get a return on a deposit or similar investment; and their clients who are willing to pay for the use of that money. But banks must not create the money. The money system belongs to the Nation and our Federal Government must be the only entity with the power to issue and regulate our money as the U.S. Constitution already mandates. We nationalize the monetary system, but don’t nationalize the individual banks. That would be a dangerous step towards fascism. Private enterprise is a powerful mechanism that can produce excellent results when properly structured and regulated. That is an important American “theme!” The AMA does not throw out the baby with the bathwater! But it most certainly gets rid of the bathwater, which is private money creation. That acts like a private tax on the rest of us! We regard such nationalization proposals (nationalize all banking) either as an inability to understand the difference between nationalizing the money system and nationalizing the private banking business, OR as possibly attempts to actually block proper monetary reform, because you’d have to change the essence of America in order to do it. So it distracts from real reform. The AMA reform that we advocate actually puts into place the system that most people think we have now! People think our money is provided by government. They erroneously believe that the Federal Reserve is already a part of our government. They think the banks are lending money which has been deposited with them, not that they are creating that money when they make loans. Under the AMA many of those things people already believe about money and banking actually become true! It’s a natural fit with already existing attitudes. 7) Doesn’t your AMA proposal merely continue with a fiat money system? Shouldn’t we be using gold and silver instead? Wouldn’t that provide a more stable money?Our system is absolutely a fiat money system. But that’s a good thing, not a bad one. In reaction to the many problems caused by our privatized fiat money system over the decades, many Americans have blamed fiat money for our troubles, and they support using valuable commodities for money. But Folks! The problem is not fiat money, because all advanced money is a fiat of the Law! The problem is privately issued fiat money. Then that is like a private tax on all of us imposed by those with the privilege to privately issue fiat money. Private fiat money must now stop forever! Aristotle gave us the science of money in the 4th century B.C. which he summarized as: “Money exists not by nature but by law!” So Aristotle accurately defines money as a legal fiat. As for gold, most systems pretending to be gold systems have been frauds which never had the gold to back up their promises. And remember if you are still in a stage of trading things (such as gold) for other things, you are still operating in some form of barter system, not a real money system, and therefore not having the potential advantages as are available through the American Monetary Act! And finally as regards gold and silver: Please do not confuse a good investment with a good money system. From time to time gold and silver are good investments. However you want very different results from an investment than you want from a money. Obviously you want an investment to go up and keep going up. But you want money to remain fairly stable. Rising money would mean that you’d end up paying your debts in much more valuable money. For example the mortgage on your house would keep rising if the value of money kept rising. Also, contrary to prevailing prejudice, gold and silver have both been very volatile and not stable at all. Just check out the long term gold chart. 8} How can a bank lend money if they have to keep 100% reserves?The 100% reserve provision applies only to checking accounts. This question results from economists classifying our AMA as a “100% reserve” plan, as the Chicago Plan was known. But our plan fundamentally reforms the private credit system, replacing it with a government money system. The accounting rules are changed. Banks will be encouraged to continue their loan activities by lending money that has been deposited with them in savings and time deposit accounts; or lending their capital that has been invested with them. It is in the checking account departments that the banks presently create money when they make loans in a fractional reserve system. This will be stopped by new bank accounting rules. Making loans from savings account is a different matter, because real money, not credit will have been transfered into such accounts, and loaning that out does not create new money or give the bank any seigniorage, that belongs to our society. Some money loaned out of a savings type account might later get redeposited into another savings account and again be reloaned, but its the same money, not any newly created money, and will reflect that way on the bank's books. This is sufficient to solve the problem of banks creating "purchasing media" by loaning their credit which then functions as money in the present system. (for details see the wording on pages 8, 9, and 14 of the American Monetary Act at http://www.monetary.org/amacolorpamphlet.pdf) Various types of accounts will have differing requirements: e.g. matching time deposits to loan durations, lessening the “borrowing short term and lending long term” problem. Money market and mutual fund type accounts can be very flexible. The principle applied will be to encourage good intermediation of money between clients who want a return on their money and those willing to pay for using it; but will prohibit money creation. Checking accounts will become a warehousing service, for which fees are charged. Good accountancy can achieve these results. (Please see # 9 below for more info on the many sources of money for these accounts.) 9) If banks are no longer allowed to create money, where will banks get enough money to fill client’s needs for money under the American Monetary Act?We devote substantial space to this question because economists so used to confusing credit and money have to get used to the idea of money instead of credit. Usually they want to know how the AMA creates money within the present bank accounting framework. Well it does not! The AMA will change the accounting rules to deal with money not credit. There will be several substantial sources of money for banks to satisfy their clients money needs: a) Title III of the AMA converts through an accounting procedure, the existing credit the banks have circulated through loans (about $6 to 7 trillion, roughly the existing “money” supply) into US money, no longer bank credit. That process will indebt the banks to the government for the amount converted over and above their capital. At present when bank loans are repaid to the banks by their customers, those credits/debts go out of circulation/out of existence and the credit money supply contracts as loans are repaid, until they make new loans. But under the American Monetary Act, since it’s now money, those monies will not go out of circulation the way the credits did. They are repaid to the government in satisfaction of the debt the banks incurred in converting them from credit to money. That goes into a pool which can be used by Congress for the items in Title V of the AMA (as described on pages 8 and 9), or it can even be re-lent to the banks at an adjusted interest rate. Note: this action de-leverages the banks, but does not reduce the money supply.b) Probably the most important source of funds for bank lending will be the continuing government expenditures, over and above tax receipts, such as social security and other payments by government on the items in Title V of the American Monetary Act. Also the engineers tell us that $2.2 trillion is now necessary to make our infrastructure safe over the next 5 years. That’s $440 billion new money per year. Also the health care and education provisions, and grants to states in Title V can be introduced as new money. ALL these will eventually be deposited into various types of bank accounts where provisions of the Act will allow this money to be lent or invested. The banks will be lending and placing this money that has been deposited with them; not lending credit they create, masquerading as money. They will have to compete to attract such deposits from citizens and companies. c) Title II of the AMA specifies the repayment of US instruments of indebtedness (bonds/notes/etc). Instead of being rolled over as at present, new US monies will be paid to the bondholders as they become due. Those people/institutions will be looking for places to invest that money. One place would be in bank stock, which is a source of lending funds for banks. Of the $5 to 7 trillion in US bonds and notes privately held, about 3.5 trillion is due within 1 to 5 years; .72 trillion is due in 5 to 10 years; .35 trillion is due in 10 to 20 years. All these amounts will represent newly created US money and will eventually find their way to becoming new lend-able or investable bank deposits and even investments in banks. d) Finally the AMA does not allow the banks to decide their own leverage situations. The Act essentially eliminates most leverage from the banking system in a healthy, non deflationary way. That will be good. They will no longer be able to pretend they were “banking” when they made bad loans overextending their positions and creating bubbles, in order to grab huge bonuses on imaginary profits. In other words banks will no longer be able to make loans in a bubble creation process. That will be a big improvement! 10) How will the U.S. Treasury create the money?"The same way the Federal Reserve does now, as simple account entries, but as income, without the accompanying debt obligations. It’s described in the AMA, Sec. 103 NEGATIVE FUND BALANCES: The Secretary of the Treasury shall directly issue United States Money to account for any differences between Government appropriations authorized by Congress under law and available Government receipts. 11) Is there any chance the AMA could eliminate the federal income tax?It “could,” and though that’s not likely in the near future, it is the direction the AMA goes in. Thanks to the immense savings our government will experience through control over its money system, taxation should decline substantially for middle and lower income groups. It should be raised for the super rich. In addition the AMA should directly lead to substantial reductions in interest rates, because as the US pays off its national debt in money rather than rolling it over, those receiving those payments will be looking for places to loan and invest those funds. Interest rates should drop substantially. 12) Why does the American Monetary Act have an 8% maximum interest rate, including all fees?Because before 1980/1981, forty nine States had “anti-usury” laws which limited normal interest rates to a maximum of between 6% and 10% p.a. (one state had 12%). The American Monetary Act takes the middle of this range to represent a restoration of the interest rate limits prevailing across the country prior to 1980/1981. See page 9 of the AMA. 13) Won’t you be breaking the sanctity of contracts when you convert the existing bank credit already in circulation, into U.S. Money? No. First of all a contract requires understanding of the terms by all parties to it, and that certainly did not exist. But more likely it will be viewed as very acceptable by the banks, considering the security it confers on banking, especially when the alternative is going broke. There would be no reason to extend the legal tender privilege (acceptance for taxes) to the credits of any disagreeing banks. 14) How would the ACT affect our position with China?The ACT would have a number of positive effects on Chinese - American Trade. Particularly it would encourage the Chinese to use more of their dollar earnings to really trade with us rather than just sell to us, and then invest their earnings in US bonds as at present. More details forthcoming! 15) What about other countries, and international systems such as the IMF (International Monetary Fund) and the BIS (Bank for International Settlements)? We’d expect other countries to follow quickly in our footsteps to each obtain the advantages of issuing their own national monies. The United Nations is already putting forward suggestions that member states shift now to nationally created, debt free; interest free moneys. They are way ahead of the US Congress just now. A much reformed IMF, already organized under United Nations Article 57; #3, will see a greatly expanded role for the SDR and more responsibility for international accounts clearing as well as real assistance to member states, rather than acting as a destructive collection agent for the big banks. The role and importance of the BIS should be rapidly reduced, and perhaps eliminated. Just look at the mess created under their guidance and rules. Some job they did! 16) The latest craze “question” making the rounds in the organized disinformation campaign that is attacking our national psychology, is not a question at all, but a vicious assertion:

“Government is so corrupt and so much in the hands of the worst people and they won’t ever let you do this reform! Or any good thing”This popped up simultaneously from LA to Seattle. I’ve told friends to put that stupidity out of their minds. This assertion, designed to discourage, is a variant of the Sun Tzu method of winning the battle by convincing the opposition not to fight because they can’t win. It reminds me of the cyborg "Borg Wars" line “Resistance is futile” from the Star Trek New Generation series. Don’t fall for it!As our people suffer more deeply from the unfortunate monetary/banking system, any remaining bad elements in government can and must be cleansed. That’s what we’ll do instead of whining about it. Become a part of the solution not a cry-baby! Get up and fight for your family and nation! “Put a stone in your stomach!” is an old phrase of Zulu warriors when summoning courage. Earlier tonight I saw an electric message on a local banks billboard: “If you think you can, you can. If you think you can’t, you can’t!”Yeah! We never said all bankers are evil, but there’s a very bad controlling element among them. 17) Why didn’t nationalized money systems work in the former Soviet countries?Because their monetary systems were still controlled from within their banking systems, using the same faulty methods. The 1966 Federal Reserve publication Money, Banking, and Credit in Eastern Europe states: “In the communist countries, money is created in the same way as in capitalist countries – through the extension of bank credit. This fact is not generally recognized or accepted in the various countries of Eastern Europe. The result is that a good deal of confusion emerges from their economic literature with regard to the nature of money and the role of the monetary process and the function of the banking system.… Since Marx identified money with gold, the official theory holds paper money to be merely a substitute for gold and ignores deposit money.” (p. 42-43) Sound familiar? Their politicians and economists were as dumb as ours! 18) Won’t we get hyper-inflation like Zimbabwe?No. For governments or anyone to issue money, there has to be a functioning society with enough rule of law and physical and social infrastructure to support the creation of values for living. Zimbabwe unfortunately does not have those pre-requisites; thus their society is falling apart. 19) Should we have the individual 50 states own banks? Like North Dakota?More Kool-Aid and distractions…Look folks the objective is to get the banks out of the Money creation field, not to get the government into banking!! A highly distracting idea that does not in any way accomplish any necessary reform! Instead it gives our fraudulent banking system a moral free pass! It is mind boggling that progressive people fall for this. (see the home page for an in depth article by Jamie Walton on this) 20) How about local currencies?Local currency movements can help people to understand the money problem but it would be an illusion to think that local currencies would stop a mismanaged, unjust national system from unfairly concentrating wealth; from being a motivating factor for warfare; from financing harmful polluting activities even when saner alternatives exist. Understand also that a national currency properly placed under governmental control gives much greater local control than the present national currency under private control, because locally, our voting power can exert influence on national policy. And remember the principle of subsidiarity put forward by E.F. Schumacher. His slogan was not “small is beautiful.” What E.F. Shumacher actually said is what the AMI is saying: Use an “Appropriate scale”- do things on an appropriate scale. That dominant scale in the currency area is national and will continue to be for the foreseeable future. The appropriateness of acting on the national level must be recognized.

|

|

|

|

|

49

|

The Economy / SOLUTIONS! / Reducing U.S. Debt and Creating Jobs Through Public Control of Our Money System

|

on: May 16, 2011, 11:26:13 am

|

http://www.huffingtonpost.com/stephen-zarlenga/reducing-us-debt-and-crea_b_857230.htmlReducing U.S. Debt and Creating Jobs Through Public Control of Our Money Systemby Stephen Zarlenga TheHuffingtonPost.com May 3, 2011 Coauthored by Greg ColeridgeFor all the boisterous talk and debate by Congressional leaders of both parties and the President about the many ways to reduce our nation's deficit and debt while maintaining vital services and programs, there continues to be a roaring silence about a solution that has nothing to do with the budget. It has to do, rather, with our nation's monetary system. Be it for ignorance or by intention, few federal elected officials have examined how a change in the way money in our nation is created and issued could reduce our nation's deficit and debt and, in doing so, increase millions of vital jobs to transform our economy. One of the few exceptions is Rep. Dennis Kucinich (D-OH), who during the last Congressional session introduced H.R. 6550, The National Emergency Employment Defense Act. A revised version is expected to be soon reintroduced. Americans would be wise to rally behind it. The basis of the bill are three essential monetary measures proposed by the American Monetary Institute in their American Monetary Act (AMA). The AMA's recommendations are based on decades of research and centuries of experience; are designed to end the current fiscal crisis in a just and sustainable way, and are aimed to place the U.S. money system under our constitutional system of checks and balances. The three essential measures include: [ Continued...]

|

|

|

|

|

50

|

The Economy / SOLUTIONS! / Forbes Predicts U.S. Gold Standard Within 5 Years

|

on: May 16, 2011, 11:24:47 am

|

Toward the end of The Money Masters (released in 1996), Bill Still makes the following prophetic warning: ''Our country needs a solid group who really understand how our money is manipulated and what the solutions really are, because if a depression comes there will be those who call themselves conservatives who will come forward advancing solutions framed by the international bankers.

"Beware of calls to return to a gold standard.

"Why?

"Simple. Because never before has so much gold been so concentrated outside of American hands, and never before has so much gold been in the hands of international governmental bodies such as the World Bank and International Monetary Fund.

"A gold-backed currency usually brings despair to a nation, and to return to it would certainly be a false solution in our case. Remember: we had a gold-backed currency in 1929 and during the first four years of the Great Depression.